Even though we are hearing that the economy is improving for some Americans, one area where many residents of Dade, Broward, and Monroe County still financially struggle is medical debt created by doctor and hospital bills.

Report: 20 Percent In U.S. Have Unpaid Medical Bills

Medical debt often comes about when someone experiences a serious medical crisis and needs inpatient hospital care, expensive medications, or ongoing treatment for a catastrophic injury or illness. When a serious medical condition arises, usually the individual and his or her family are looking for the best medical care available. Cost and charges take a back seat to saving a family member’s life or helping them recover their health to the extent possible.

While it can be overwhelming if you have incurred significant medical bills, you are not alone. In fact, a new report released by the Consumer Financial Protection Bureau (CFPB) found that almost 43 million Americans have overdue medical debt on their credit reports.

Some noteworthy points contained in the CFPB report include:

- Half of all overdue debt on credit reports is from medical debt – According to the CFPB’s findings, 52 percent of all debt reported on credit reports is from medical expenses. When a medical debt is reported as past due, the reporting agency flags the debt as an account in collections, which results in a reduced credit score.

- One out of five credit reports contains an overdue medical debt – One out of five U.S. residents (or 43 million people) has an unpaid medical debt that is adversely affecting his or her credit report.

- The sole collection item for 15 million Americans is medical debt – For seven percent of all consumers (15 million Americans), the only collection items listed on their credit reports is medical debt. The CFPB’s research showed that these particular Americans are likely to be consumers who normally meet their debt obligations and who are generally reliable bill payers who normally meet their debt obligations.

Steps For Dealing With Medical Debt

For those who have medical debt bills, here are some tips that may be helpful:

- Review all medical bills for accuracy– While it can be overwhelming to receive a significant number of medical bills, it is important to check each bill for accuracy. This includes reviewing the name of the provider, the date of service, as well as other items on the bill. The bill should be itemized well enough for you to verify whether you received the recorded service on the date indicated by the invoice.

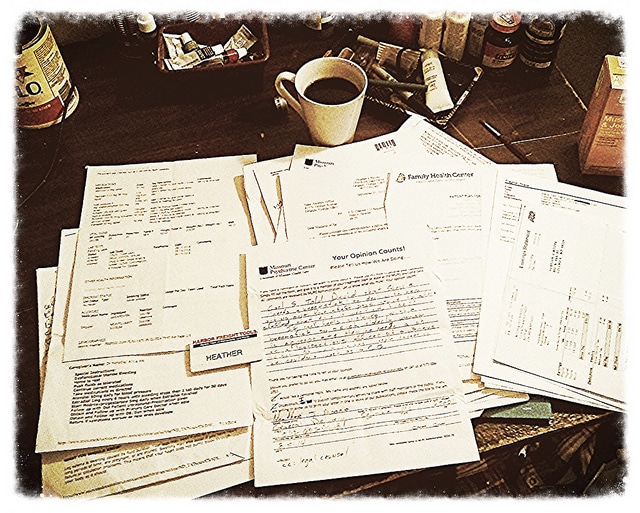

- Keep organized records of all bills– Set up a filing system that allows you to track bills as they come in. If you need to dispute the charges contained in a particular bill, you will want to make a copy of the pertinent invoice. Do not send your original invoice as you may need to refer to it in the future.

- Try to become familiar with what is and what is not covered by your insurance. It is important that you have an understanding of what is, and what is not, covered by your insurance, in order to avoid costly out-of-pocket charges. If you have questions, or are unclear on what may be covered, use the customer service number provided by your insurance carrier to ask questions, or ask to speak to someone who’s familiar with these issues at the medical facility.

- Document any conversations regarding bills or collection matters. Before you make any phone calls regarding your medical bills or bill collection matters, be ready to take notes regarding the conversation. When you contact an insurance provider or a medical billing office, take notes regarding the date and time of the phone call, the full name and title of the person you speak with regarding your issues, and any relevant information that you are told regarding the matter that you call to discuss.

- Act quickly to resolve or dispute questionable charges. No one likes dealing with controversies. However, if there appears to be a discrepancy regarding a medical invoice, it is important that you contact the insurance carrier or the medical billing office of the provider who sent the bill as soon as you notice the problem. Dealing with disputes is typically easier if the matter is dealt with as soon as possible.

- Don’t feel bad about attempting to negotiate your bills. Ask the hospital, clinic, or physician’s office to if they will adjust the rate that you were charged to something more affordable. Alternatively, request a payment plan that will allow you to make installment payments at no interest. Healthcare providers know that they will receive pennies on the dollar if you file for bankruptcy, so they may be willing to work with you to find an amount that you can live with paying.

- Consider filing for bankruptcy relief. If your medical bills have reached the point where you are unable to financially manage them, filing for bankruptcy relief may be an answer.

Dade, Broward, and Monroe County Bankruptcy Help For Those With Medical Debt

Sometimes a medical crisis can become financially overwhelming. High-deductible insurance plans may require families to pay more out-of-pocket costs. Medical treatment costs can run into the tens of thousands or more. Medication costs can be exorbitant. Loss of income for a sick or injured individual can be financially devastating.

Whatever the particulars, sometimes the best course of action for an individual or family is to seek protection provided under the United States Bankruptcy Code. Under Chapter 7 bankruptcy, medical debts can typically be discharged (wiped out), giving the individual and his or her family a fresh start financially.

If you have questions about obtaining financial relief from your medical or other bills, contact Hoffman, Larin & Agnetti, P.A. for a free consultation regarding your Florida bankruptcy options. Our friendly and knowledgeable Florida bankruptcy attorneys are available to help you get the new start you deserve. Call us today at 305-653-5555 or use our online contact form to the right today.